What Is A Blanket Mortgage in Pre-Construction?

A Blanket Mortgage in pre-construction developments is actually a misnomer, it should be called a Blanket Appraisal.

What Is A Blanket Mortgage / Appraisal?

Every mortgage requires a market appraisal which is an independent, professional estimate of the property’s market value, usually done right before closing. Lenders use it to make sure the home you’re buying is worth what you’re paying for it.

A blanket appraisal is when the bank pre-appraises your pre-construction unit now at the original purchase price, instead of relying on a new appraisal of the current market value performed at completion and can literally save your closing.

Why Does This Matter?

If the market appraisal comes back at the original purchase price of above, then everything is good and there are no issues!

But a common scenario in today’s real estate market is that appraisals are coming in less than the purchase price. This is VERY common in the GTA and even starting to happen in Calgary (I just saw a new condo building in Calgary have appraisals came in $10k ABOVE the purchase price, but some came in as low as $100k UNDER! It all depends on the appraiser you get and how conservative they are being, which is completely outside of your control.

What Happens Next?

Banks will only lend to a maximum of value of 80% on an investment property (known as Loan-To-Value), so if your appraisal comes back under the purchase price, then you are required to bring extra cash at closing as an additional down-payment - this is above the 20% already required for an investment property.

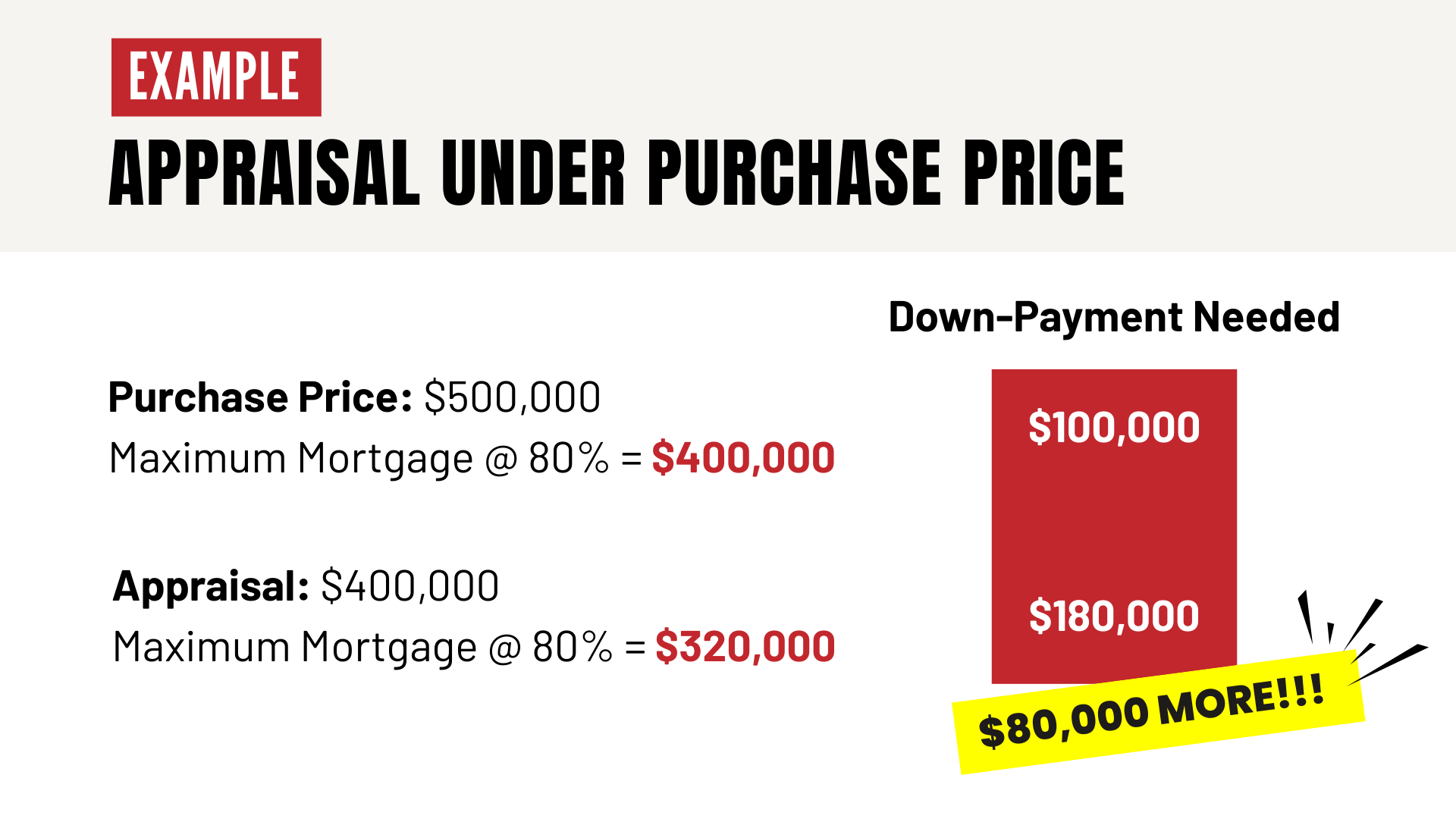

Here’s an Extreme Example:

Purchase Price: $500,000 | Maximum Mortgage @ 80% LTV = $400,000

Appraisal: $400,000 | Maximum Mortgage @ 80% LTV = $320,000

Difference = $80,000

Down-Payment Required

Original 20% Down-Payment = $100,000

Extra Down-Payment Now Required = $80,000

Total Down-Payment Required to Close = $180,000

So instead of needing $100,000 as a total down-payment on a $500,000 purchase, you now need an extra $80,000 in cash for a total of $180,000 down-payment! Most people don’t have an extra $80K laying around.

If you don’t have this extra cash available, then you can’t get a mortgage. If you can’t get a mortgage, then you can’t close. Click here to learn more about what happens if you do not close on a pre-construction purchase.

Why Should Buyers Care?

A Blanket Mortgage/Appraisal benefits you in several ways:

No Surprise Down-Payment Needed: The builder is basing the mortgage financing on the original purchase price, so there is no chance that the appraisal value can come in lower than your purchase price. This means there’s no chance that you will need to bring more than the standard 20% down-payment at closing and has been a lifesaver for many clients who don’t have extra cash readily available!

Save $500! Since no appraisal is performed at closing, you don’t need to pay for one which can save you around $400-$600.

Early Approval: Banks will often allow you to qualify for the mortgage today, even though you won’t get the property for several years. This has huge benefits because many buyer’s life situations change in this time (job changes, family situations, moving, etc.). Plus the appraisal is normally performed as the last step of the mortgage approval process, so if you run into any issues, you have no time to get another mortgage approval - you are stuck.

Interest Rate Hold: You can lock in a mortgage rate today (banks will hedge against rising interest rates) and if the rate goes down, the bank will decrease the rate accordingly, giving you the chance to secure better rates closer to closing. You may not get the absolute best interest rate but you will get a competitive offer.

Flexibility: You are not bound to the mortgage approval, and can shop around at closing to see if you can get a better mortgage that better fits your needs if you are okay to roll the dice on the appraisal.

Much Lower Stress: Being unsure if you will qualify for a mortgage while your closing date is quickly approaching is incredibly stressful - trust me, I have been there! By getting your approval today for your closing in a few years, you completely eliminate this stress because you know you are already approved and having a mortgage option you can rely on, which is invaluable - I can’t stress this enough.

What's my Recommendation?

If a pre-construction development is offering a blanket mortgage option, I always sign up! I have personally had some sleepless nights because of mortgage issues, so do yourself a favour and get the approval so you can sleep easy.

It’s always better to secure a mortgage, than to risk it all tryin to save a few dollars shopping around for a slightly better interest rate.

SPECIAL NOTE: Truman Homes Buyers in Calgary

Great news for anyone that bought a pre-construction condo by Truman Homes - TD Bank is offering a blanket mortgage on virtually all of their projects, including:

Arthur Condos

Broward Condos

Clover Condos

Frontier Condos

Gallery Condos

Hazelwood Condos

Horizon Condos

Imperia Condos

Lincoln Condos

Myne Condos

Orson Condos

Plaza Condos

Violette Condos

Benefits of TD‘s Blanket Appraisal:

No appraisal is required: Appraisals in Calgary have been coming back all over the place - some below buyer's purchase prices. The blanket mortgage means that no appraisal is required, so you won't be required to come up with any more than the standard 20% down-payment at closing (click here for more information).

Firm approval: TD has said your approval will stay valid under your closing so that you don't have to requalify at closing like a pre-approval, so if you lose your job, run into financial issues, or your life changes, you don't need to requalify (please confirm this with TD)! Even though you haven't received your closing notice yet, you can still apply.

No Market Rent Analysis: Since your unit has a rental guarantee, they can use this to support your mortgage application.

Competitive Market Rates: TD will guarantee the fixed interest rates and will even lower it if market rates drop by your closing (they also offer competitive variable rates but specific rates can't be confirmed until closer to your closing).

Promotions: TD is constantly offering cashback promotions that can help offset some of your closing costs (which should be less than $4,000 total).

Maximum Flexibility: You don't have to use TD for your mortgage if you can find a better mortgage and are okay rolling the dice with the appraisal but this gets you a fantastic backup option many people are wishing they had right now.

No Downside: Except the hassle of providing all the documents required.

It's more important to secure a mortgage than to try and save a few dollars on a slightly lower interest rate. Appraisers in Calgary are starting to be very conservative and I recently saw an appraisal come back $130,000 short (the buyer would have had to bring an extra $104,000 in cash to close the deal) > this won't happen to you under this program.

Contact me if you would like the TD Contact for the blanket mortgage option.