Calgary Real Estate is UNDERVALUED.

Fiver years ago I started selling pre-construction properties in Calgary because the city offered fundamentals that I couldn’t find in the GTA -incredible potential for appreciation, positive cash flow, and strong rental demand. Smart investors are shifting their investments from Toronto and Vancouver because they recognized the incredible potential - I have now helped over 500 people from across Canada to buy pre-construction properties in Calgary.

Prices from the $200s

5-10% Deposits until closing

Positive Cash Flow at today’s mortgage rates

Rental Guarantees with FREE Property Management

Minimal Closing Costs (under $3,000)

NO Land Transfer Taxes ($20k+ savings compared to GTA)

NO Developments Charges ($20k+ savings compared to GTA)

Voted #1 most Livable City in Canada and North America

Most affordable living costs for any major city in Canada

Lowest tax rate in Canada: No PST, just 5% GST

Register to Get the

Top Calgary Investments

Calgary Is My Top City for Investment

I strongly believe in the Toronto/GTA and Vancouver markets long-term but I’m sick and tired of getting gouged by government fees and taxes. You pay nearly 10% of the value of the property for the pleasure of closing on it - development charges and land transfer taxes are completely out of control. Instead, use that cash for the down-payment on a property in Calgary - the basic investment fundaments just make sense - Calgary prices 50% lower than Toronto or Vancouver, Rents are higher per dollar invested and properties are Cash Flow Positive:

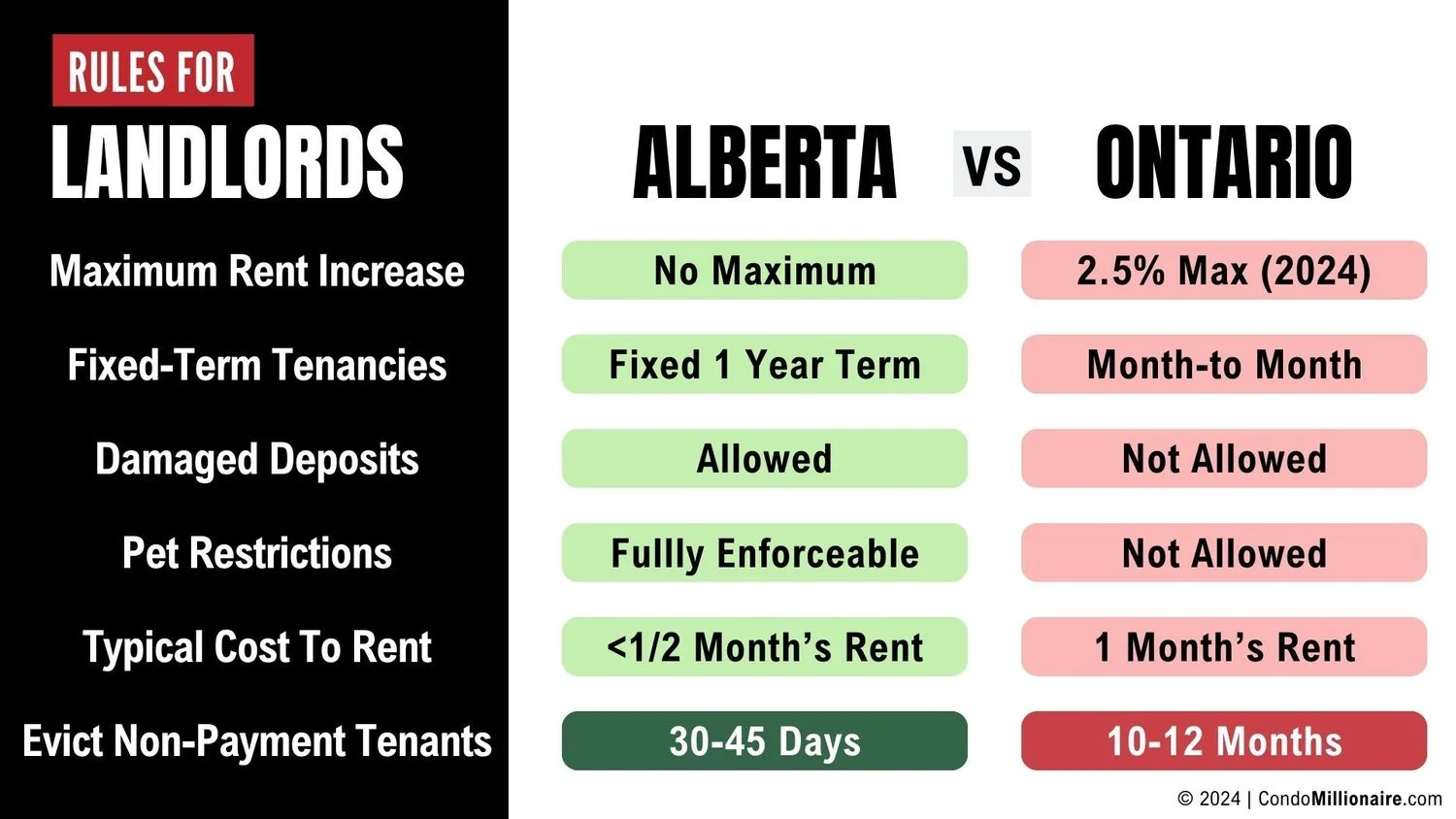

Landlord Tenant Rights

Simply put - the Ontario landlord-tenant board is broken with some people waiting up to 6 years before their hearings , with a backlog of 36,000 applications. Not to mention that over 50% of applications in Toronto have been reported as fraudulent. If you run into any issues in Ontario with your tenant, good luck! You are not going to get relief from the government any time soon.

Alberta does not have these issues and natural eviction methods are built into the system there if your tenant is not able to pay their rent. Let’s compare the provinces (and BC isn’t much better than Ontario). Being a Calgary landlord is a dream and landlord rights are actually enforced.

Case Study Successes

East Hills Crossing (East Calgary)

This is a pre-construction condo I personally bought:

Type: 2 Bedroom, 2 Bath, 710sf, Parking & Locker • East Calgary • Bought Oct 2020

Purchase Price: $245,690 • Deposit: $12,285 • Rental Guarantee : $1,283/mo.

CURRENT MARKET VALUE: $345,000 • CURRENT RENT: $1,600/mo.

GAIN: $99,310 • RATE OF RETURN: 814%

I put down a deposit of only $12,285 and it has appreciated nearly $10,000 - a return of 814% on the deposit I put down. Rental rates in the area are now well above the guaranteed rental amount and the property pays me every month.

Yorke Townhomes (NE Calgary)

Clients who invested in Yorke Townhomes “hit a homerun”:

Type: 3 bed, 3 bath Townhome, 1,248sf, Tandem Garage • NE Calgary • June 2021

Purchase Price: $369,900 • Deposit: $36,990 • Rental Guarantee: $1,900

CURRENT MARKET VALUE: $470,000 • CURRENT RENT: $2,150/mo.

GAIN: $100,100 • RATE OF RETURN: 271%

These townhomes are now closing and investors are taking possession. Units have been appraised at $470k, that’s a gain of $100,000, a 271% return)!

Calgary is a Canadian Powerhouse

No one was talking about Calgary 2 years ago. Prior to the pandemic, Calgary’s real estate was in a period of decline, still recovering from its 2015/15 recession. Real estate prices had fallen from the peaks and were (and still are) considerably lower than the national average. As the pandemic hit, grave concerns about Calgary’s economy were raised due to the steep decline in oil prices with oil hitting -$40/barrel at one point. Even in the face of this, real estate generally saw less than a 1% decrease in price during the second quarter of 2020. By the end of the year, overall prices only decreased by 0.68%, after having dipped by 3.4% and 1.68% in 2019 and 2018, respectively. That situation has complete changed today and Alberta is now leading economy growth in Canada (and the growth is not related to oil & gas)!

Calgary has the largest concentration of head offices in the country and the second-largest concentration of small businesses—signs of an economy with diversity and growth. It acts as a major hub for transportation for the Prairies, eastern British Columbia and some parts of the northern United States. The IT Technology and Green Technology sectors are exploding in Calgary and becoming very important parts of the economy. Companies continue to setup operations in Calgary and many are moving their headquarters to the city and it shows - people are now flocking to the city for those well paying jobs and incredibly affordable lifestyle.

What You Need to Know About Investing In Calgary

Investing from out of province works the same as if you were standing in Calgary in-person yourself and everything can be done remotely, including management of the unit! You never have to go to Calgary or even see the unit you purchased.

-

Once you have decided to move forward with a unit, you submit a Suite Reservation Form or “Worksheet” to me (see here). This contains the information that the developer needs to prepare the purchase agreement and includes basic information like: your legal name, address, phone #, email, occupation, employer and a picture of identification (typically a driver’s license or passport).

This also helps me keep track of which unit you want, if parking and a locker will be purchased (typically they cost extra), if there will be multiple purchasers or if you will be adding a Holding Company to the purchase agreement.

Some situations you must act fast, literally within minutes or you will miss out - pre-submitting a unit registration form means I can instantly reserve units for you, instead of having to wait for you to submit the form.

It takes less than 5 minutes to complete. Here is the form:

www.condomillionaire.com/reserve -

The developer prepares your purchase agreement based on the information submitted. Most developers prepare the Agreement of Purchase and Sale (APS) within 24 hours because it is a fairly automated processes. You are typically required to sign the agreement within 24 hours of receiving it or the developer will void the contract and take the unit back. This is to weed out the people that are not truly serious in moving forward with a purchase and to start “the clock” (i.e. the 10 day cooling period).

-

I have had developments sell out in less than 2 hours. This means that for many projects you have to make a split second decision and commit before being able to complete your due diligence. Protected by Alberta law, you are given 10 days to back out of a deal for any reason with no penalty. This is 10 calendar days and starts on the day you sign (weekends and holidays count!)

If you decide for any reason that you do not want to move forward with the email, you can back out of the purchase by sending an email to the builder to let them know you will not be moving forward (there isn’t even a form, it’s that simple).

-

You do not need a lawyer to buy a pre-construction property - you technically only need one at closing. However I always recommend to have your purchase agreement reviewed by a lawyer within the cooling period to ensure that there are no “deal breakers” or terms that you cannot live with. Sometimes you can negotiate contract terms but 99% of the time, it is take-it-or-leave-it and contracts are always written to favour the developer.

You want to use a lawyer in Alberta because real estate law is slightly different across each province who understands the nuance and technicalities of their jurisdiction:

Examples:

“Duplex” in Ontario means a property that has two units that can be rented but in Alberta, it means a semi-detached property.

“Occupancy” in Ontario is the time period between when you can move into the unit and when final closing and legal title is passed to the buyer. In Alberta, this concept does not exist and buildings usually go straight to closing.

Also to close a property, the lawyer must also have access to the land titles registration system in the respective province, if you already have a lawyer - check with them to see if they can do it, otherwise I can refer you to one.

-

A mortgage is only needed at CLOSING, not when you initially purchase the pre-construction unit.

Getting a mortgage in Alberta is exactly the same as in any other province (all large banks and financial insinuations operate across all of Canada). You only get an actual mortgage at CLOSING, not when you sign the purchase agreement. However, most developers require you to provide a mortgage pre-approval within your cooling period. This is a “soft” approval that will look at your employment, income, debts, real estate holdings, etc. but your credit score is not checked.

Getting a mortgage pre-approval should be your first step before even looking at any properties. This identify what your borrowing capacity and budget should be (if you are trying to buy a $1M property but only qualify for a $300k mortgage, you should not be even looking at it!!)

The actual mortgage financing depends on your financial situation at closing several which can be several years from now. At that time, they will need to re-verify all of your information and do a hard credit check before mortgage financing can be provided. Banks are very backed up due to Covid and I have seem many deals be delayed because of it with penalties and fees to buyers - ORGANIZE YOUR MORTGAGE AS EARLY AS POSSIBLE!

Not all mortgage brokers can place mortgages in Alberta though; if you are already working with one then ask them if they can. Otherwise, I work with mortgage broker partners that can help without much pain or fuss - email me if you need a referral.

NOTE: When you close on the property at the end, to get a traditional mortgage from EVERY bank in Canada, you must have at least A 20% DOWN-PAYMENT for a rental property. If you put down a 10% deposit with the developer, you would need to put down another 10% at closing (all deposits given to the builder count towards the 20% requirement). If you see anyone advertising less than 20%, it is for an owner-occupied home where you must get CHMC insurance or is simply not true.

-

Sometimes developers will allow you to provide post-dated personal cheques but 90% of the time they require deposits to be provided by one of the following methods:

1) Wire Transfer - you go to your local bank and they will wire the funds to the developer’s lawyer (costs about $50)

2) Bank Draft (MOST COMMON) - you go to your local bank and get a Bank Draft. You then go to the developer’s lawyer’s bank (typically BMO or TD) and have them deposit it straight into their account (costs about $8)

Deposits are protected by provincial law and held in-trust by the developer’s lawyer. If the building is cancelled or the developer goes bankrupt, your deposits are protected and you will get them back.

-

NOTE: I am not a tax expert so please consult with your accountant.

There are no special taxes or fees that related to buyers that live in a province other than Alberta. Alberta is a great place to invest because it has:

• NO FOREIGN BUYER TAX: anyone can buy real estate there without paying any special “foreign” taxes. If you are a Canadian citizen or permanent resident, you can even buy real estate anywhere in Canada and you will not pay any Foreign Buyer Taxes.

• NO LAND TRANSFER TAX: there is no specific taxes related to the real estate transaction like there are in BC and Ontario (this is a savings of $32,950 compared to selling a $1M property in Toronto). There is a Property Registration Fee but this is only a few hundred dollars.

• NO DEVELOPMENT CHARGES: development charges are essentially taxes by the local municipality to pay for infrastructure and Alberta is very anti-tax; these simply don’t exist at all in Calgary.

• NO PROVINCIAL SALES TAX: in Alberta, you will only pay 5% sales tax on goods and services purchased.

If the property has appreciated in value when you sell it, the rules related to income taxes are determined by the CRA (Canada Revenue Agency) which is a federal entity and the treatment of income and capital gains is handled the same way across provinces.

-

All new homes in Alberta are covered by the Alberta New Home Warranty Program - this provides coverage for a 10 year period:

• 1 YEAR - MATERIALS & LABOUR: Coverage for defects in materials and labour (baseboards, flooring, trim, and paint).

• 2 YEAR - DELIVERY & DISTRIBUTION SYSTEMS: Coverage for defects in materials/labour related to delivery & distribution systems (heating, electrical and plumbing systems).

• 5 YEAR - BUILDING ENVELOPE: Coverage for defects in the system of components that separate the conditioned space from unconditioned space (roof, exterior walls).

• 10 YEAR - STRUCTURAL: Coverage for the load-bearing parts of the home (frame, foundation).

Prior to closing on the unit, there will also be an Occupancy Inspection to walkthrough the property to inspect for any deficiencies. You can do this yourself, you can send someone anyone to do it on your behalf, or you can have a building designate walk you through the inspection remotely on a Zoom call. There are always “deficiencies” that the builder will fix and touch up and some seasonal items and exterior work may not be able to be completed until later (e.g. pouring concrete, landscaping, etc.)

-

I have many clients that do not live in the cities where there investment units are. Many choose to manage the units themselves and anything can be ordered online nowadays (especially for condos since normally the worst that happens is a plumber of locksmith needs to be called). This is especially true for condos.

However if you are a remote investor, go in with the assumption that you will be hiring a property management company to manage the unit for you. They are the boots on the ground and take care of: tenant communications, coordinate payments, statutory and government compliance, maintenance and repairs, day-to-day management of the unit. You should only need to get involved if a decision needs to be made or if an invoice needs to be paid.

The most you should pay for property management in Alberta is 10% of gross rent + GST. I’ve seen as low as 6% but use 10% for your financial analysis.

For my hands-on clients, I recommend trying to manage the unit by yourself for a few months and see if it goes. You can always hire a property manager later or if you get into trouble…

-

In Alberta, most units are rented by property management companies, not by real estate agents like in Ontario and BC. They handle the listing and advertising of the unit, coordinating showings, due diligence on prospective tenants (employment, references, social media, credit score, etc). The typical charge is 1/2 a month’s rent + GST whereas in the GTA the typical fee is 1 month’s rent.

Your only involvement in the rental process should be reviewing the due diligence provided by the property management company for prospective tenants and giving your approval.

-

At closing time, all of the related closing activities can be performed remotely including: signing paperwork with the lawyer, coordinating the mortgage with the broker, organizing insurance, taking possession of the unit/keys, etc.

Closing costs are the fees and costs associated with transferring the legal title to your name - these are DRASTICALLY different between Ontario/BC and Alberta. Below is a comparison of closing a $500,000 one bedroom pre-construction condo in Calgary VS Toronto:

TYPICAL CLOSING COSTS IN CALGARY:

• Land Transfer Tax: $0

• Development Charges: $0

• Lawyer & Legal Fees: $1,250

• Title Insurance: $250

• Registration Fees: $420

• GST Rebate: $0*

• TOTAL: $1,920

CLOSING COSTS IN TORONTO:

• Land Transfer Tax: $12,950

• Development Charges: $15,000

• Lawyer & Legal Fees: $1,000

• Title Insurance: $200

• Misc Fees: $1,500

• HST Rebate: $24,000**

• TOTAL: $54,650

* There is a 36% GST rebate up to $6,300 that applies in Alberta but it is a sliding scale and goes away completely at $450k.

** Once you rent out the unit for at least a 1 year tern, you can apply for the HST Rebate in Ontario and you almost always get back the full $24k so this becomes a cash flow issue, not a true expensive