What is Interim Occupancy Vs Final Closing

This is one of the most misunderstood things in pre-construction real estate investing - what is Interim Occupancy versus Final Closing?

Interim Occupancy

Interim Occupancy is the period of time between when you get your keys to move-in to your new condo unit, and when you close on your new home (i.e. when the Title transfers into your name). This means that your unit is complete, issued an occupancy permit, and you can move in—but the condominium corporation isn’t yet fully registered, and legal title remains with the developer.

Triggered once the municipality issues an occupancy permit for your unit

You don’t yet own the unit—legal title still belongs to the developer

You begin paying interim occupancy fees, even if you don’t move in

Interim Occupancy is different in each province - in Ontario, it affects every pre-construction property, in BC it is much more uncommon and in Alberta, there is no interim occupancy period - properties go straight to closing

When Will Interim Occupancy Closing Happen?

The timing of your Interim Occupancy Closing is outlined in your Agreement of Purchase and Sale (APS), specifically within the Statement of Critical Dates. This section includes:

First Tentative Interim Occupancy Date – the earliest estimated date your unit may be ready for occupancy.

Notice Period for Delay – the deadline by which the builder must inform you if there’s a delay to the first tentative date.

Outside Occupancy Date – the final date by which the builder must deliver occupancy. They can delay multiple times, as long as it’s before this date.

Purchaser’s Termination Period – if occupancy doesn’t happen by the outside date, you have 40 days to cancel the agreement by providing written notice.

It’s important to understand these dates and their implications, as delays in pre-construction are very common (especially in Ontario). Once the builder is confident the unit is ready, they will provide you with a Firm Interim Occupancy Closing Date.

How Long Does Interim Occupancy Last?

Typically, the occupancy period can range from 2 to 12 months, and contracts may allow up to 24–36 months. I’ve personally seen condo buildings in interim occupancy for over 2 years. Lower‑floor units frequently experience longer occupancy periods than the rest of the building because the 3rd floor might be completed while the 50th floor isn’t even built yet. The occupancy period for condo townhomes is usually much shorter, a few months at most.

What You Pay: Interim Occupancy Fees

Once you move-in to your new home and start your interim occupancy, you will need to pay an interim occupancy fee to the builder (not a mortgage). The fee is determined by the Condominium Act, and covers three things:

Interest on the unpaid portion of the purchase price, using the Bank of Canada’s prescribed 1 Year Conventional Mortgage Rate which is currently 6.09% (much higher than current mortgage rates)!

Estimated property taxes

Estimated maintenance/condo fees

These "phantom rent" payments often approximate what a mortgage would cost but don’t build any equity equity in the unit. Developers are not allowed to profit from these fees—they can only recover their carrying costs as set by law.

Your Rights & Restrictions During Interim Occupancy

You can live in the unit, but you have limited legal rights.

Renting or selling the unit during this period usually requires builder consent or authorization, and may incur fees or approval clauses in your APS (Agreement of Purchase and Sale).

You must have legal or financial preparedness, including post‑dated cheques and proof of insurance, even if you don’t move in—fees are owed regardless.

What is Final Closing?

Once the developer has completed the condominium building and the condominium corporation has been registered with the land registry office, triggering legal transfer of the title into your name, the Interim Occupancy ends and you have your Final Closing.

The Closing Date is the date that the title transfers into your name and you are able to register a mortgage against the property. At this time, you will no longer pay an interim occupancy fee and instead will begin making mortgage payments, pay property taxes and start paying your condo fees, as you have full ownership of the condo.

Your mortgage is activated and you begin principal + interest payments.

Title transfer is completed.

Closing costs become due—land transfer tax, legal fees, Tarion warranty fees, development levies, and prorated adjustments for taxes/fees, etc.

Ownership rights commence: you can now sell, rent, refinance, etc., without further permission from the developer

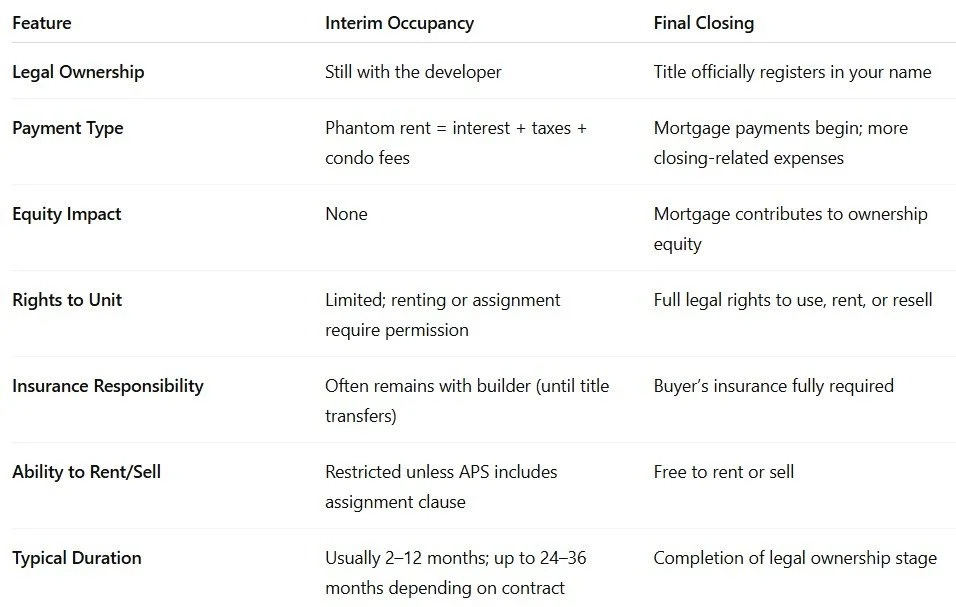

Interim Occupancy vs Final Closing: Side-by-Side Comparison

Final Thoughts

Interim occupancy is one of the most ridiculous concepts ever dreamed up - I don’t know how developers were able to get this passed into law. Yes, it gives the buyer early access to live in your new condo, but it comes with monthly fees that don’t reduce your purchase price or build equity and are well above current mortgage rates. Ownership—and all the legal and financial rights—only arrives at final closing, after the condo is registered and title is transferred so you are stuck in a legal limbo, sometimes for years.

Reach out if you would like help calculating your occupancy fees or have any questions.