Mortgage Disability Insurance - How It Works

Mortgage disability insurance covers your monthly mortgage payments if you become disabled and are unable to work due to an illness or injury. Instead of paying off the full mortgage like Mortgage Life Insurance, it covers your payments temporarily—usually for a fixed period or until you recover.

How It Works

You pay a monthly premium that is typically bunded with your mortgage payments.

If you become disabled and can't earn income, the insurance pays your mortgage payments for a set time (commonly up to 2 years).

A waiting period (often 30–90 days) usually applies before payments begin.

Proof of disability (often through a doctor or insurance adjuster) is required.

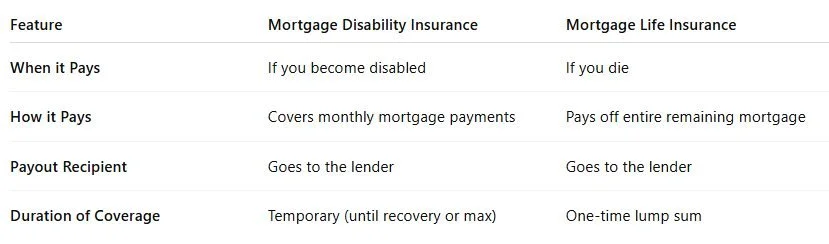

How it Differs from Mortgage Life Insurance

Pros

Helps protect your credit score and avoid foreclosure.

Keeps your investment properties afloat during unexpected income loss.

Provides peace of mind for self-employed investors or those without workplace coverage.

Cons

Can be expensive, especially if bundled through your lender - there are usually cheaper options available from insurance companies.

Benefit caps may not fully cover all housing costs (e.g. condo fees, property tax).

Fine print varies—some policies won’t cover pre-existing conditions or part-time income.

For Real Estate Investors

If you're using rental income to pay your mortgage, this insurance can help cover gaps if you’re sidelined and unable to manage properties or work your primary job.

Many investors opt for private disability insurance with broader coverage, or use emergency reserves as part of a larger risk management strategy.

Mortgage Disability Insurance isn’t really needed because ideally the rent from the unit should be enough to cover the expenses of carrying the property including the mortgage - this means that the payments of the mortgage are not dependent on your ability to work but always review with a professional to determine your specific insurance requirements